IPSAS 41, Financial Instruments

IPSASB

| Handbooks, Standards, and Pronouncements

English

In progress Translation:

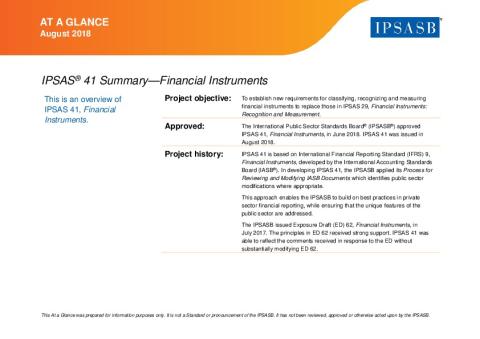

IPSAS 41, Financial Instruments, establishes new requirements for classifying, recognizing and measuring financial instruments to replace those in IPSAS 29, Financial Instruments: Recognition and Measurement.

IPSAS 41 provides users of financial statements with more useful information than IPSAS 29, by:

- Applying a single classification and measurement model for financial assets that considers the characteristics of the asset's cash flows and the objective for which the asset is held;

- Applying a single forward-looking expected credit loss model that is applicable to all financial instruments subject to impairment testing; and

- Applying an improved hedge accounting model that broadens the hedging arrangements in scope of the guidance. The model develops a strong link between an entity's risk management strategies and the accounting treatment for instruments held as part of the risk management strategy.

Copyright © 2026 The International Federation of Accountants (IFAC). All rights reserved.